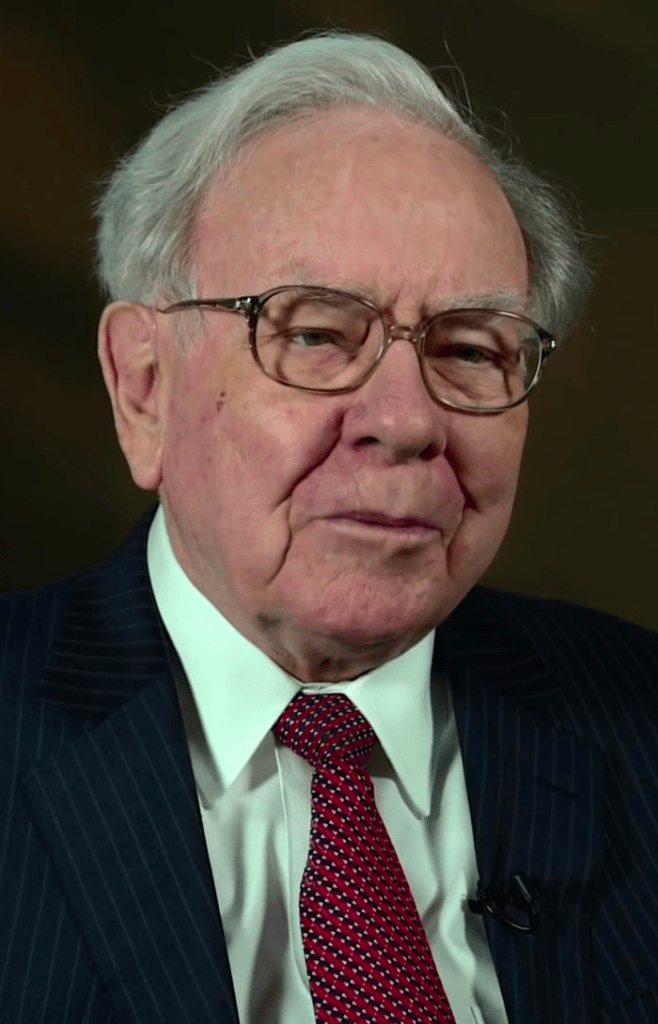

The Oracle of Omaha. Warren Buffet is considered by many to be the greatest investor of all time. He is also one of the world’s richest people and has pledged to give away 99% of his fortune. His advice is sound and simple.

Why listen to Warren Buffet?

He has been able to generate an average annual return of 20 % since 1965. That alone should be enough to make you pay attention to what he has to say. Berkshire Hathaway, his investment company, has a current market cap of USD ~669 billion. In addition to his stellar performance in the investment world, Buffett has great values, a long-term view and is living life in his own terms. He seems to be happy.

What to learn from Warren Buffet?

#life, #principles, #investing

Buffett is not investing in stocks. He is buying businesses. He believes that he is not able to predict how the macro environment and the market will behave in the short term but he is great at evaluating certain types of companies and their long term competitive advantage. Buffet believes that he has a circle of competence – an area where he has an edge in evaluating companies – and he likes to stay inside that circle.

Ideas / Quotes

“Only when the tide goes out do you discover who’s been swimming naked.”

“We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

“Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Resources

Letters to shareholders – https://www.berkshirehathaway.com/letters/letters.html

Leave a comment